Disjointed data and teams

After years of point-solutions for capturing, archiving, and surveilling new communications channels, these fragmented systems were not only cumbersome to manage but also failed to provide a comprehensive view of traders' activities.

And with teams spread across the globe using multiple tools, people stuggled to collaborate and manage the heavy workload.

As a result, the firm found it difficult to adapt to the evolving communication landscape and felt they were not doing enough to truly address potential risks and protect their reputation in the energy trading industry.

Unable to focused on risk

Data was flowing but risk insights were not.

Instead of focusing on risk, teams were distracted by processing meaningless alerts.

Alerts generated by keywords either were clearly noise or lead to an immense manual effort to clarify the context behind the remaining conversations.

Their technology stack created too much work and left the true insights into risk invisible.

An avalanche of meaningless data

With more and more data being generated by the proliferation of communications channels, the team faced a massive volume of alerts - and almost all of it irrelevant.

Poor scoring parameters made it impossible to prioritize the right data, resulting in a backlog that was too difficult to handle.

Communications data came in multiple languages, adding extra complexity routing the right alert to the right team member.

This simply wouldn't scale.

Unscalable infrastructure

They had problems with data silos, holding different data sources on different on-prem and cloud data systems with complex policy management.

Inconsistent data formats and lack of interoperability between different tools meant a huge headache any time a regulatory shift or change in requirements occured.

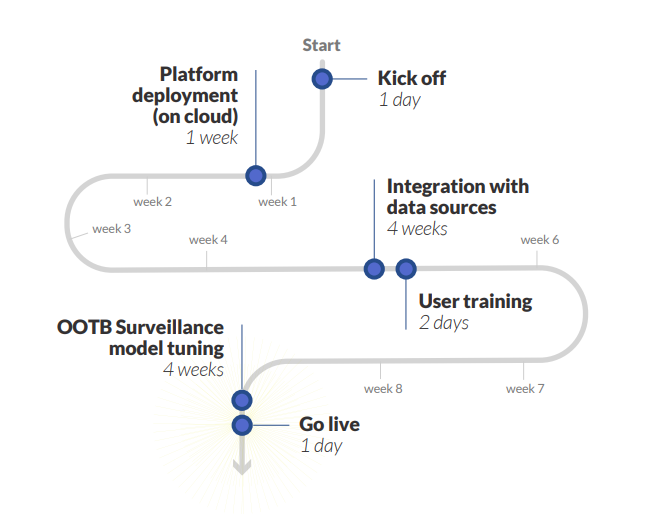

With rising costs and increasing pace of change with global regulations and communications channels, it was decided the right cloud partner would be needed to become more flexible and scale.